Exemption for working mothers: from May, NoiPA will apply the benefit

The exemption from contributions will be applied starting from the May payslip. January-April 2024 arrears will be paid with an urgent issue, on a second payslip.

With the regular issue of May 2024, NoiPA will apply the contributory exemption provided for by the article number 1, paragraph 180, of the 2024 “Legge di Bilancio” (so-called bonus moms) for working mothers who have requested it. The amount of the benefit varies based on the calculation of the pension benefits due, with a maximum monthly limit of 250 euros.

For working mothers who are entitled to it but are not yet benefiting from it, it will still be possible, at any time, to communicate the desire to take advantage of the benefit to the administration to which they belong.

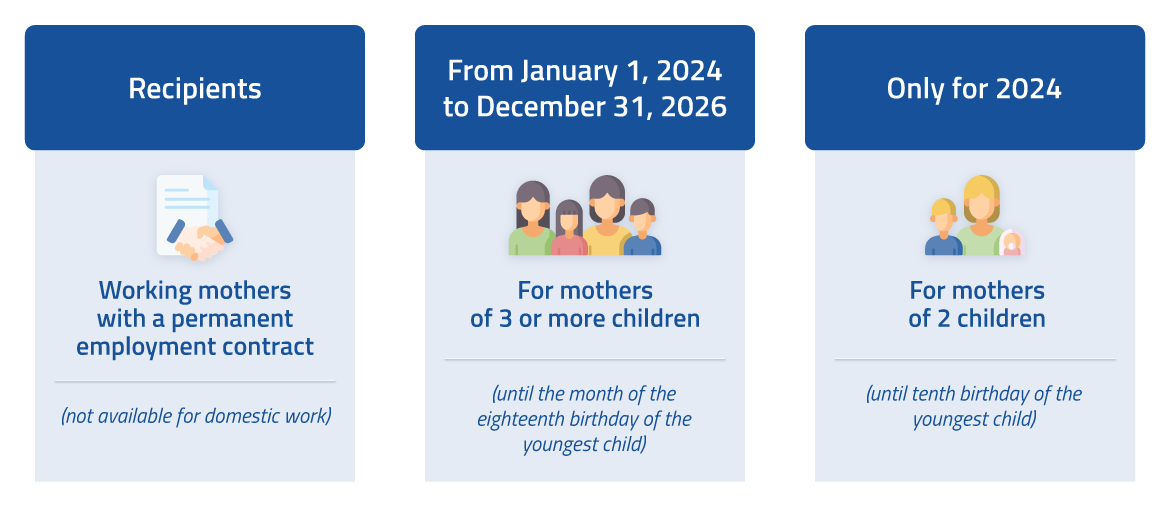

Who is entitled to the benefit

The benefit is for workers, mothers of three or more children, with a permanent employment contract, for pay periods from January 1, 2024 to December 31, 2026. The measure of the exemption is equal to 100% of the quota of social security contributions for Disability, Old Age and Survivors (IVS), charged to the worker until the month of the eighteenth birthday of the youngest child, with a maximum annual limit of 3,000 euros (250 euros monthly). For pay periods from January 1, 2024, to December 31, 2024, on an experimental basis, the exemption is also extended to workers, mothers of two children, until tenth birthday of the youngest child.

Payment of arrears: calculation method

The payment of the arrears for the period January 2024-April 2024 will be made with an urgent issue in May 2024 with enforceability within the same month. The detail of the amounts paid will be reported on a different payslip than the regular one for the May installment. It should be noted that the exemption for working mothers is alternative (and not cumulative) to the IVS contributory exemption of 6% or 7%, provided for by Decreto Lavoro (decreto-legge May 4, 2023, n. 48) which has already been applied for the first three months of the year. Therefore, in calculating the total amount of arrears due, the amounts due as an exemption will be subtracted from those possibly already recognized as an IVS contributory exemption of 6% or 7% for the months of January, February and March 2024. In the same way, the IVS exemption relating to the month of April 2024, whose application was expected on the May 2024 installment, will be completely replaced by the arrears of the urgent issue of May 2024.

Inps Utility: clarifications for NoiPA users

With the message May 6, 2024, n. 1702, Inps communicated that working mothers can now transmit directly to the Institute, through the Utility exemption working mothers application, the information related to the tax codes and personal data of their children, in case the employer has not yet transmitted them. However, for employees of entities managed by NoiPA who have already requested an exemption, it is not necessary to use the application made available by the Institute, as the administration to which they belong has already provided to enter the tax codes of the children for which the benefit is used into the system.

14/05/2024