How to read the NoiPA payslip

An illustrated guide to help you navigate through the details of your NoiPA payslip, which contains information related to your monthly salary.

An illustrated guide to help you navigate through the details of your NoiPA payslip, which contains information related to your monthly salary.

The payslip is an electronic document that can be downloaded from your personal area.

It provides detailed information about the salary of public sector employees. The payslip follows a standard structure, consisting of two main parts. It counts one or more pages depending on the amount of information presented.

To clarify, it is possible to divide the two parts of the payslip into different areas (sections). The first part, which provides an overview of the employee’s position, consists of the following four areas:

The first area contains essential information, including the indicative payment information for the month and year of remuneration, as well as the payslip ID identified by conventional progressive numbering.

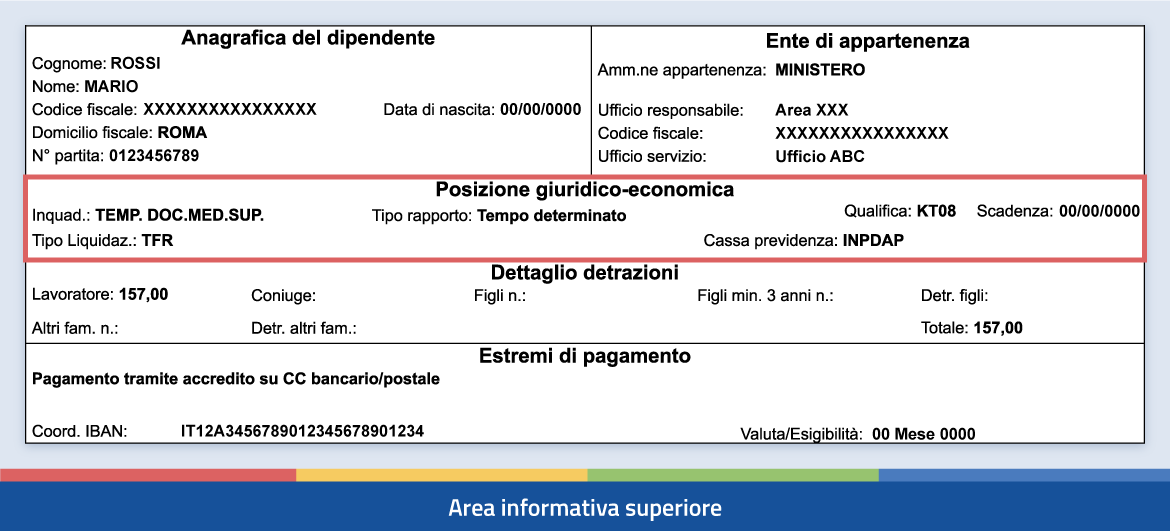

This section contains information about the employee’s personal situation, the relevant government agency, the legal-economic position of the worker, details of deductions, and payment items.

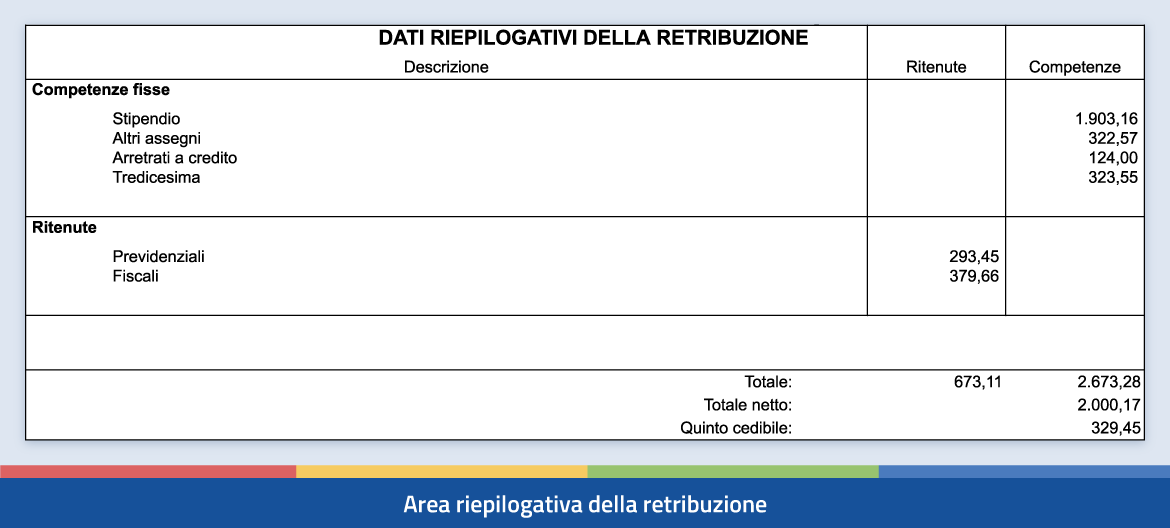

In the subsequent section of the payslip, employees find summarised data related to compensation, including total amounts for:

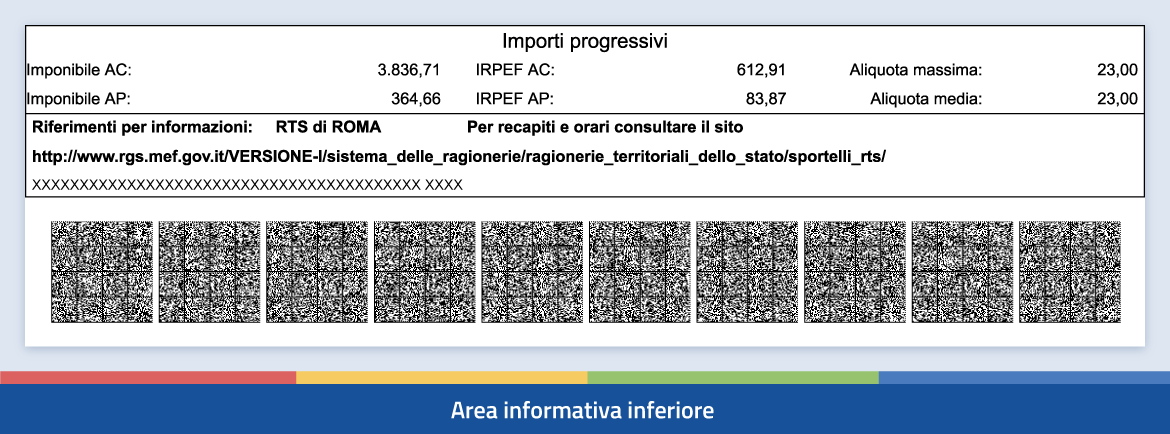

In the last part of the first section, progressive amounts, taxable income, and IRPEF (both for the current year, AC, which stands for Anno Corrente, and the previous year, AP, Anno Precedente) are reported. Additionally, in the right column, you’ll find the IRPEF tax rates: the maximum rate applies to compensation for the current year, while the average rate is used for calculations related to any retroactive payments and, in general, for compensation in the current year.

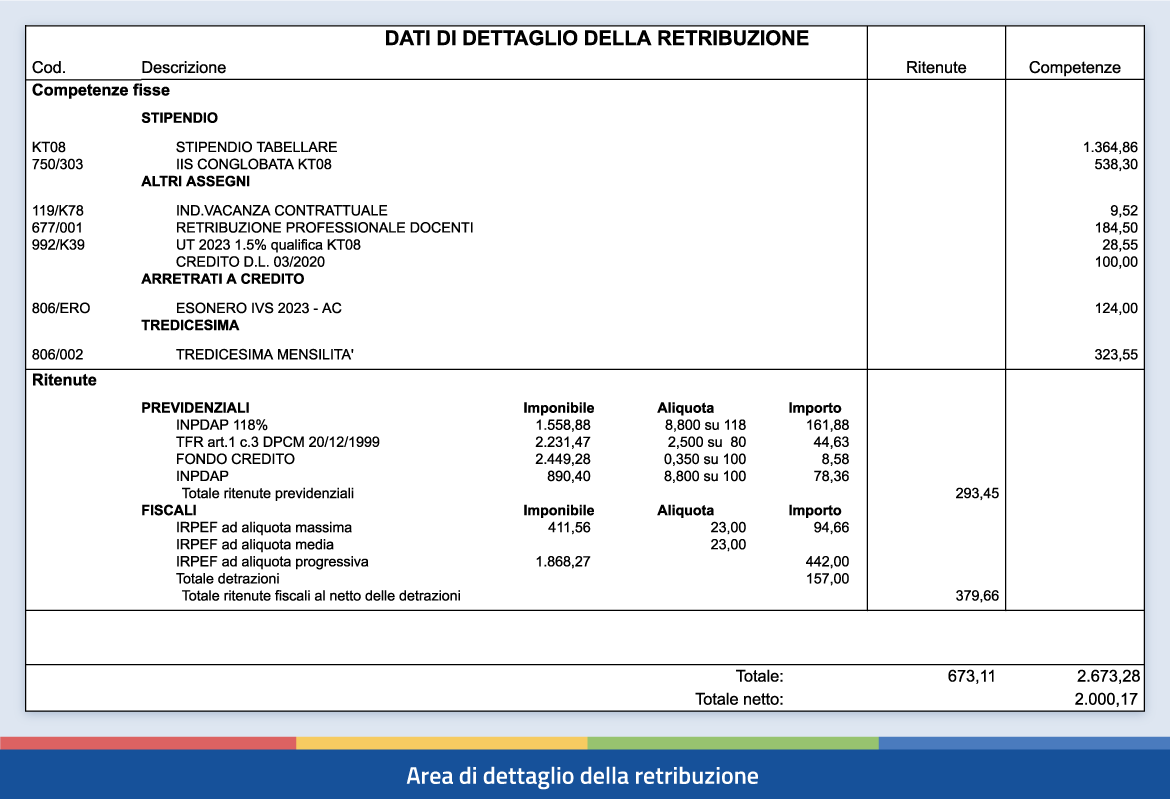

In the second part of the payslip (which often coincides with page number 2 of the document), in addition to the same information already reported in the header area, upper information area, and lower information area of the first part, employees also find additional detailed information related to compensation.

In the section entitled “Compensation detail data,” various items that make up the total amounts already reported in the “Summary of compensation” (present on the first page of the document) are illustrated. This allows employees to have a more precise and in-depth view of fixed components, additional components, withholdings, and tax and social security adjustments. In this section as well, gross, and net totals for different items are highlighted.

Since the structure of information may vary slightly for different sectors, it is possible to contact the relevant administration representatives for further information. Additionally, employees can request support within NoiPA: assistance services are available in the dedicated Mondo NoiPA - Support section of the portal or by accessing their personal area.